Mortgage points break even

This means that paying points saved you 16223 over the course of your 30-year mortgage. What Is the Break-Even Point on a Mortgage.

Buying Down Points Mortgage Points Break Even Calculator Point Break Savannah Real Estate Georgia Coast

Compare Best Mortgage Lenders 2022.

. In this example if you refinance your original mortgage with 5 rate into a 3 mortgage your monthly payment will increase by 6125. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

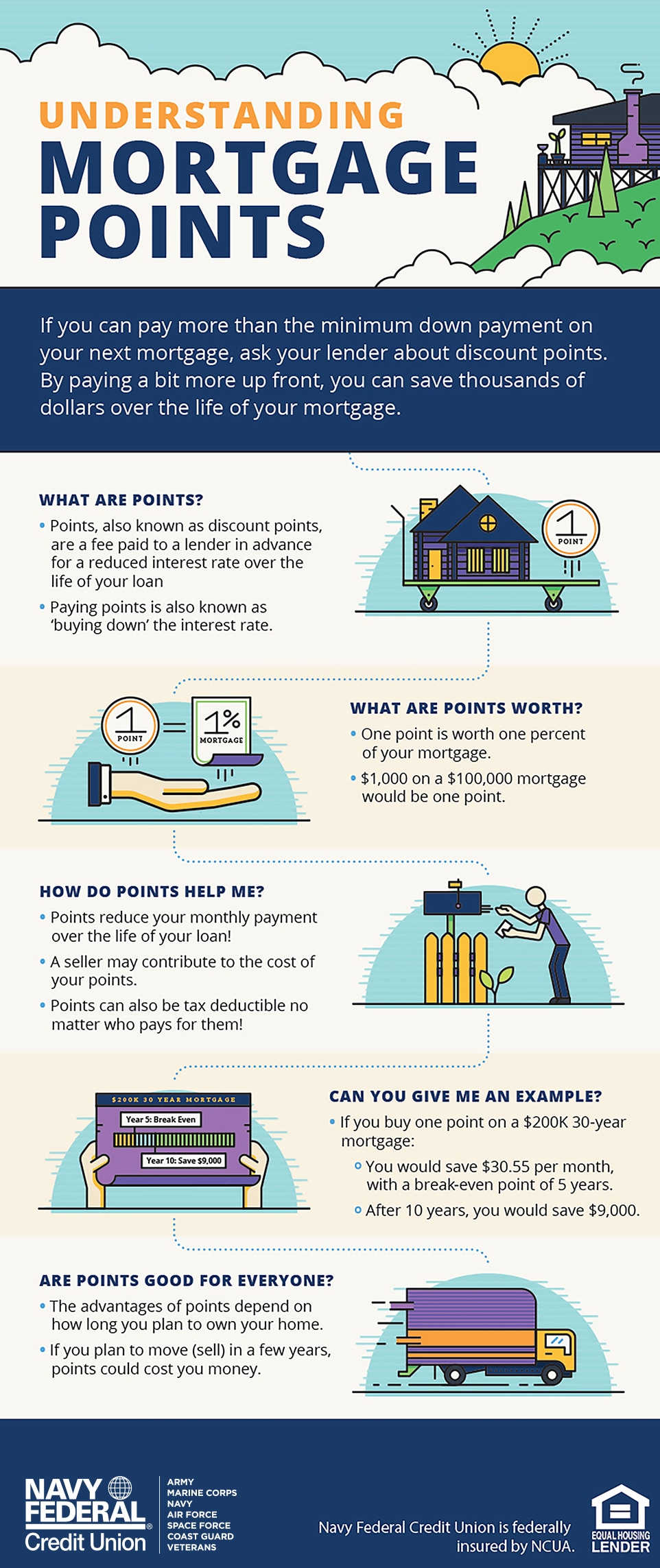

Dividing 3000 by 33 you get 91 months you have to wait to break evenMost people see the light and opt out of doing it Sometimes the light can blind. Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount. To determine the break-even point you divide your closing costs by the amount you save every month.

Keep in mind that assumes youll stay current on your payments for the entire 30 years of your loan term. It would take you 100 months or a little over 8 years to break even. A Ton Of Course Options For Completing Your WA Mortgage Pre-Licensing Classes.

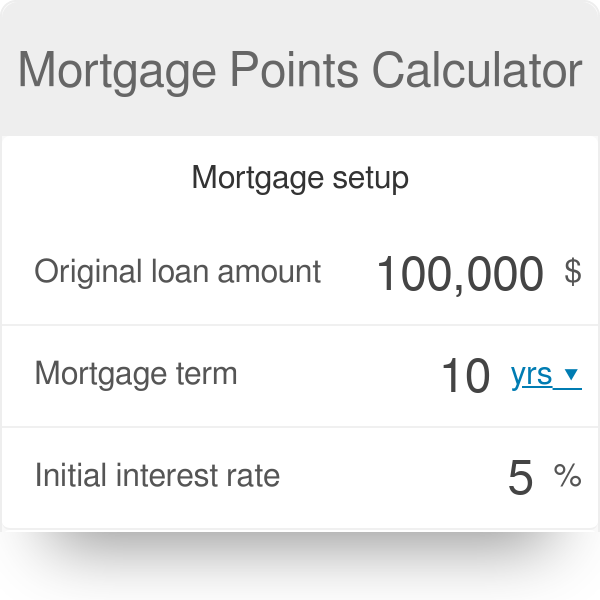

The result is the amount of time it would take you to breakeven on the deal. What you must now determine is the time you expect to remain in the home for you to at least reach the break-even point. Mortgage Points Calculator 11a Break-Even Period on Paying Points on Fixed-Rate Mortgages Who This Calculator is For.

When the accumulated monthly savings equal the upfront fee youve hit the break-even point. The initial interest rate was 3. 1 point will lower your interest rate from 3 to 275.

On a 200000 loan a 14 lower rate reduces the monthly payment by about 33 a month whereas 15 points amounts to 3000. The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments. To figure out when youll break even if you buy mortgage discount points take the cost of the points and compare it to how much youll save each month if you have a lower interest rate.

Youll also save 6381838 in interest charges over the life of the mortgage. Affordable NMLS Approved Licensing With The CE Shop. 1 point 4000.

The break-even period is the time it takes to recoup the cost of buying points. After that you come out ahead. The break-even point is when the interest you saved is equal to the amount you paid for mortgage points.

So if points cost you 2000 and saved 40 per month then it would take 50 months to break even 200040 50. The break-even point varies depending on the size of the loan the interest rate and the term the. Under the right conditions purchasing points when you purchase a home can save you quite a bit of money over the full length of your loan term.

This calculator shows the costs and benefits of paying points to reduce the rate on an FRM. Up to 25 cash back Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025. Alright its time to go back to math class again.

Divide the 6000 of paid mortgage points by the 8781 in monthly savings which equals 68 months to recoup your initial investment. Over 30 years without paying down the loan early the cost of the loan with interest is 391809. Each point you buy costs 1 percent of your total loan amount.

Interest Saved by Refinancing. The concept of the break-even point is simple. Apply Online Get Pre-Approved Today.

After you break even youll start saving money. For example if the introductory period on your mortgage is 5 years then your break-even point should be less than 60 months. They sort of cancel each other out.

Lets use a quick example to explain how this might work. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. As an example lets say you save 50 per month by refinancing but the loan comes with 5000 in closing costs.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. However if you opt for the 175-point discount you end up paying 375586 over the life of the loan. Not only should the break-even point be before the time you plan to refinance the loan but it should also be less than the introductory period of the loan or else it wouldnt make sense to purchase.

To do this just divide the cost of the mortgage point. So you might have to pay four points to reduce your rate by a full percent. Ad Mortgage Self Study Course.

Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning the home after reaching the break-even period. Balance of Refinance at Breakeven Date. In that scenario you could potentially save as much as 11424 in interest by buying points.

Lets calculate the break-even point from our example we used before. Buying points to lower your interest rate makes the most sense if you select a fixed rate mortgage and you plan on owning your home after youve reached a break-even point of 36 months or less. Borrowers who want to know whether they will save or lose money over a specified period by paying points in order to reduce the interest rate on an FRM.

What Is A Mortgage Refinance In Plain English Refinance Mortgage Home Mortgage Refinancing Mortgage

Mortgage Points Calculator 2022 Complete Guide Casaplorer

Mortgage Points Calculator Break Even Period On Paying Points Mortgage Professor Mortgage Payoff Mortgage Tips Mortgage

What Are Points And How Much Do They Cost Points Are Really Called Discount Points Technically Mortgage Mortgage Payment Mortgage Payment Calculator

Cost Analysis Templates 7 Free Printable Word Excel Pdf Analysis Words Templates

Mortgage Points A Complete Guide Rocket Mortgage

Pin On Cornerstone Personal Finance

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

10 Ways To Show Powerpoint Goals Creatively Goalsetting Leadership Goals Presentation Skills Powerpoint

China S Escalating Property Curbs Underline Xi S New Priority Real Estate Prices Real Estate Property Prices

Pin On Real Estate

Dysfunctional Family Greetings Top Ten Signs You May Have A Dysfunctional Family Square Magnet Http Www Cafepress Co Dysfunctional Family Dysfunctional Ten

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Portfolio Of The Week Gaia Russo Visualoop Infographic Data Visualization Information Graphics

Mortgage Points Calculator

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

Mortgage Points Deals 50 Off Www Wtashows Com